Bitcoin (BTC), Ethereum (ETH) & Solana (SOL) Price Predictions: October 20-26, 2025

Bitcoin, Ethereum, Solana

Executive Summary

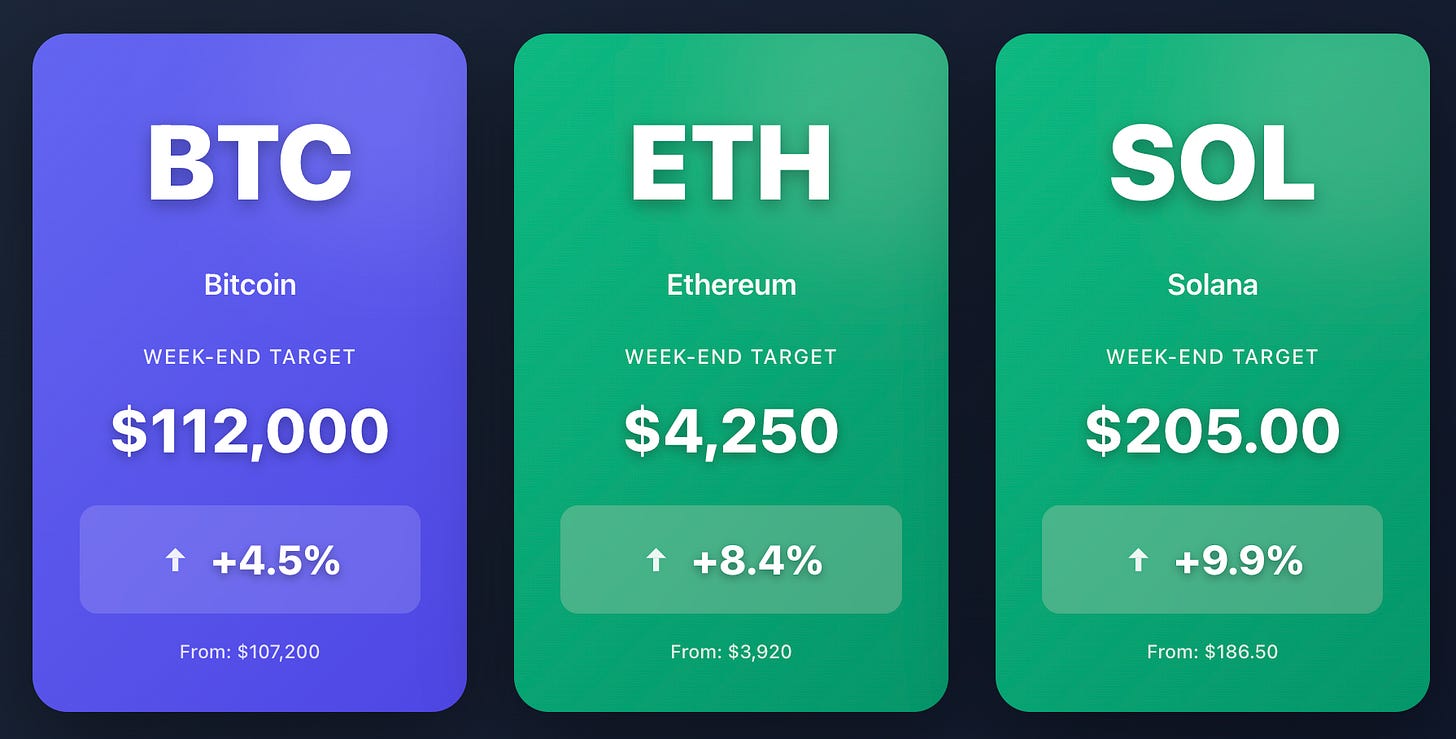

Current Prices (October 19, 2025):

Bitcoin (BTC): $107,200

Ethereum (ETH): $3,920

Solana (SOL): $186.50

Price Predictions for October 26, 2025:

Bitcoin (BTC)

Bear Scenario (10th Percentile): $102,500 | -4.4%

Base Scenario (Median): $112,000 | +4.5%

Bull Scenario (90th Percentile): $118,500 | +10.5%

Ethereum (ETH)

Bear Scenario (10th Percentile): $3,650 | -6.9%

Base Scenario (Median): $4,250 | +8.4%

Bull Scenario (90th Percentile): $4,650 | +18.6%

Solana (SOL)

Bear Scenario (10th Percentile): $172 | -7.8%

Base Scenario (Median): $205 | +9.9%

Bull Scenario (90th Percentile): $225 | +20.6%

The crypto market enters the crucial final week of October facing a pivotal moment. After experiencing its worst October in a decade with a 5% decline and a massive $16 billion liquidation shock, the market shows early signs of stabilization. With the Federal Reserve meeting on October 30th expected to deliver another rate cut and critical ETF decisions pending, the next seven days could determine whether “Uptober” can still deliver a late-month rally or if macro headwinds will continue to dominate.

Predictions with Uncertainty Quantiles

Bitcoin (BTC) - Week Ending October 26, 2025

October 26, 2025 Predictions:

10th Percentile (Bear): $102,500 - Representing a 4.4% decline from current levels, this scenario reflects continued liquidity tightening, potential Fed hawkishness, or escalation of US-China trade tensions

Median (Base): $112,000 - A 4.5% gain suggesting modest recovery momentum as the market digests recent liquidations and positions for the Fed meeting

90th Percentile (Bull): $118,500 - An optimistic 10.5% rally driven by strong institutional inflows, positive Fed signals, and technical breakout above key resistance levels

Ethereum (ETH) - Week Ending October 26, 2025

October 26, 2025 Predictions:

10th Percentile (Bear): $3,650 - A 6.9% pullback reflecting continued underperformance versus Bitcoin and concerns about high gas fees limiting adoption

Median (Base): $4,250 - An 8.4% increase as ETH benefits from DeFi activity recovery and improved sentiment following recent oversold conditions

90th Percentile (Bull): $4,650 - A strong 18.6% surge as Ethereum reclaims the $4,600 resistance level and benefits from Layer-2 adoption momentum

Solana (SOL) - Week Ending October 26, 2025

October 26, 2025 Predictions:

10th Percentile (Bear): $172 - A 7.8% decline testing the lower boundary of the $170-205 consolidation range amid broader altcoin weakness

Median (Base): $205 - A healthy 9.9% gain as SOL holds above key support and benefits from continued DEX volume dominance over Ethereum

90th Percentile (Bull): $225 - A 20.6% breakout rally as SOL exits the consolidation box and targets the next resistance zone near $240-260

Rationale and Key Factors

Recent Market Context

The cryptocurrency market experienced a dramatic shock on October 10, 2025, when President Trump’s threatened 100% tariff on Chinese exports triggered a cascade of liquidations totaling over $16 billion - the largest single-day crypto wipeout on record. Bitcoin plunged from its October 6th all-time high near $126,000 to current levels around $107,000, marking this as Bitcoin’s worst October performance since 2015.

Despite the brutal selloff, several factors suggest the market may be finding a bottom. On-chain data from Glassnode shows strong accumulation by holders with 1-1,000 BTC, while the Crypto Fear & Greed Index has cooled from “Extreme Greed” (85) to moderate “Greed” (60-62), suggesting some of the froth has been removed. Open interest has declined 5.6% to $221 billion as leveraged positions were flushed out, creating a cleaner technical setup.

The macro backdrop remains mixed. The U.S. government shutdown that began October 1st has delayed key economic data, potentially giving the Fed cover for additional rate cuts. However, liquidity conditions are tightening, with the SOFR-EFFR spread widening to 0.19 - the highest since December 2024 - indicating funding stress in financial markets. This liquidity squeeze has been a key factor keeping crypto prices suppressed even as gold and silver hit new all-time highs.

Bullish Factors (Supporting Recovery)

1. Federal Reserve Rate Cut Expected (October 30th): The market widely anticipates a 25 basis point rate cut at the Fed’s October 30th meeting. Fed Chair Jerome Powell has acknowledged “softness” in the labor market, and the Beige Book released mid-October showed growing economic weakness. A dovish Fed stance would be highly supportive for risk assets including crypto, potentially triggering a strong relief rally into month-end.

2. Historical October Strength: Despite this year’s underperformance, October has historically been Bitcoin’s second-strongest month, with a 73% probability of a positive close and an average return of +27%. The last six Octobers have all closed positive. In 2020, Bitcoin flipped from an early October loss to a 27% rally by month-end, setting up the following year’s record highs. With two weeks remaining, precedent suggests a late-month reversal is possible.

3. Institutional Demand Remains Strong: Bitcoin and Ethereum ETFs continue to see consistent inflows. U.S. Bitcoin ETFs recorded strong demand in early October, while Ethereum ETFs saw $176.56 million in net inflows on October 6th alone, with cumulative total net inflow reaching $14.6 billion. This institutional support provides a fundamental floor under prices.

4. Leverage Flush Creates Healthier Setup: The massive liquidation event has cleared out overleveraged positions, reducing the risk of further cascading liquidations. Open interest has declined to more sustainable levels, and funding rates have normalized. This reset creates a more stable foundation for a potential rally.

5. Solana Ecosystem Strength: Solana continues to demonstrate superior fundamentals with DEX volume of $94.8 billion exceeding Ethereum’s, strong staking participation (75% of tokens staked providing price stability), and the anticipated Alpenglow protocol upgrade. The first Spot Solana ETF with staking features has sparked institutional interest, potentially providing a catalyst similar to Bitcoin and Ethereum ETF launches.

6. Technical Oversold Conditions: Ethereum’s RSI reached its most oversold reading since April 2025, a condition that historically preceded a 134% rally within two months. Bitcoin is testing critical support at its 200-day moving average, a level that has held during previous bull markets and often serves as a launch point for rebounds.

Bearish Risks (Downside Factors)

1. Liquidity Tightening in Traditional Markets: The widening SOFR-EFFR spread indicates funding stress in the financial system. Banks are tapping into the Fed’s standing repo facility (SRF), suggesting liquidity constraints. This tightening typically correlates with pressure on risk assets including cryptocurrencies. Until this spread normalizes, crypto may struggle to mount a sustained rally.

2. Geopolitical Tensions and Trade War Fears: President Trump’s threatened 100% tariffs on Chinese exports have rattled global markets. If tensions escalate rather than de-escalate, the resulting risk-off sentiment could trigger another wave of crypto selling. The situation remains fluid and represents a significant tail risk.

3. Government Shutdown Uncertainty: The U.S. government shutdown that began October 1st creates policy uncertainty and delays critical economic data releases. This fog of uncertainty makes it harder for markets to price in fundamentals and increases volatility. Additionally, the shutdown has delayed SEC decisions on new crypto ETF applications.

4. Bitcoin’s Broken Historical Pattern: This is Bitcoin’s worst October in a decade, breaking a streak of six consecutive positive Octobers. The historical tailwind that typically supported crypto in October is notably absent this year, suggesting the current macro environment may be overriding seasonal patterns.

5. Ethereum Relative Underperformance: Ethereum has underperformed Bitcoin and Solana recently, with concerns about high gas fees and reduced on-chain engagement persisting. The SOL/ETH ratio has reached new highs, indicating capital rotation away from Ethereum. Until ETH can reclaim leadership, it may lag in any market recovery.

6. Technical Resistance Levels: Bitcoin faces significant resistance at $111,000-$112,000 (previous support now turned resistance), Ethereum needs to clear $4,260 to confirm a trend reversal, and Solana must break above $205-$215 to exit its consolidation range. Failure to overcome these levels could result in renewed selling pressure.

Key Events to Watch

October 30, 2025 - Federal Reserve Meeting: The most significant event for the week ahead is the Fed’s policy meeting on October 30th. Market expectations are for a 25 basis point rate cut, but the accompanying statement and Powell’s press conference will be critical. Dovish language emphasizing continued easing would be extremely bullish for crypto, while any hawkish surprises could trigger sharp selling.

ETF Decision Deadlines (October 18-25): The SEC faces deadlines on multiple cryptocurrency ETF applications, particularly for XRP ETFs from major asset managers including Grayscale, WisdomTree, and Franklin Templeton. While Solana ETF decisions have already passed, any approval of additional cryptocurrency ETFs would signal regulatory clarity and potentially trigger institutional FOMO.

China Trade Developments: Any headlines regarding the US-China trade situation will move markets. De-escalation of tariff threats would remove a major risk factor, while escalation could trigger another risk-off wave. Monitoring Trump administration statements and Chinese government responses will be critical.

Technical Breakout/Breakdown Levels:

Bitcoin: Watch for a decisive break above $112,000 (targets $118,500) or breakdown below $105,000 (risks $100,000 test)

Ethereum: Monitor $4,260 resistance (opens path to $4,670) versus $3,800 support (could slide to $3,650)

Solana: Track the $205-$215 zone for breakout (targets $225-$245) versus $170 support (risks $140-$155)

Investment Implications

For Conservative Investors

Recommended Position: Wait for confirmation before entering or consider dollar-cost averaging with heavy Bitcoin weighting

Conservative investors should approach this week with caution. The market remains in a technical downtrend despite recent stabilization, and significant macro uncertainty persists. If you’re already holding positions, consider:

Maintaining Bitcoin Core Holdings: BTC’s relative strength during the October selloff (down only 5% versus larger altcoin losses) demonstrates its role as a portfolio stabilizer. Bitcoin ETF flows provide a fundamental support level.

Reducing Altcoin Exposure: Ethereum and Solana carry higher beta and therefore higher risk. Conservative investors should limit altcoin positions to 20-30% of crypto allocations until clearer bullish confirmation emerges.

Wait for Fed Meeting: The October 30th Fed decision represents a major binary event. Conservative investors may prefer to wait until after this meeting before increasing exposure, as the outcome will significantly influence the trajectory for November.

Key Entry Signals: Consider increasing positions only if Bitcoin closes a daily candle above $112,000 with volume, Ethereum reclaims $4,260, or the Fed delivers a clearly dovish message on October 30th.

Risk Management: Set stop losses at September lows (BTC: $100,000, ETH: $3,500, SOL: $165) to limit downside exposure if the bear scenario materializes.

For Moderate Investors

Recommended Position: Build positions gradually, with equal weighting across BTC, ETH, and SOL, sized at 50-70% of target allocation

Moderate investors can begin building positions but should do so strategically rather than all-at-once. The risk/reward is improving but not yet overwhelmingly positive. Consider:

Dollar-Cost Averaging Strategy: Divide your intended investment into 3-4 tranches over the next two weeks. Enter 25-30% of your position now, add another 25% after the Fed meeting, and reserve the remainder for potential dips or confirmation of the bullish scenario.

Balanced Allocation: A 40% BTC / 35% ETH / 25% SOL split provides exposure to Bitcoin’s stability, Ethereum’s DeFi ecosystem, and Solana’s high-beta potential. Adjust based on your risk tolerance.

Tactical Trading Around Fed Meeting: Consider taking 20-30% profit if prices rally strongly into the Fed meeting (BTC $115,000+, ETH $4,500+), then looking to re-enter on any post-meeting dip.

Accumulation Zones: Look to add to positions if prices dip to support levels: BTC $104,000-$106,000, ETH $3,750-$3,850, SOL $175-$180.

Options Strategy: Moderate investors comfortable with derivatives might consider selling cash-secured puts at the 10th percentile price levels to generate income while potentially buying the dip.

For Aggressive Investors

Recommended Position: Establish full positions now with heavier weighting toward high-beta assets (SOL, ETH), use leverage cautiously

Aggressive investors seeking maximum returns should view current levels as a compelling risk/reward entry point, but must remain nimble and use proper risk management:

High-Conviction Entry: The combination of flushed leverage, oversold technicals, positive seasonality (even if delayed), and an upcoming Fed rate cut creates an asymmetric opportunity. Current prices may represent the best entry point of Q4 2025.

Overweight High-Beta Assets: Consider a 30% BTC / 30% ETH / 40% SOL allocation to maximize upside in the bull scenario. Solana’s technical setup (consolidation near support) and fundamental strength (DEX volume, staking) offer the highest return potential.

Leverage Judiciously: If using leverage, keep it conservative (2-3x maximum) and have clear stop losses. The October liquidation cascade demonstrates the danger of excessive leverage. Consider leveraged positions only in Bitcoin and only if trading above $110,000.

Take Profits Systematically: In the bull scenario, take 25% profits at the following levels: BTC $115,000, ETH $4,500, SOL $220. Let the remaining 75% run toward the 90th percentile targets.

Options for Maximum Upside: Consider buying slightly out-of-the-money call options expiring November 1st or November 8th. With implied volatility relatively low after the liquidation event, options offer asymmetric payoff if the bullish scenario plays out.

Aggressive Trade Idea: Long Solana against Ethereum (long SOL/ETH ratio). Solana has been consistently outperforming Ethereum, the SOL/ETH ratio is in an uptrend, and SOL’s fundamentals are superior. This trade profits if Solana continues its relative outperformance regardless of overall market direction.

Risk Warning: Aggressive strategies carry significant risk. Never invest more than you can afford to lose, use stop losses religiously, and be prepared to cut positions quickly if the bear scenario begins to unfold.

Methodology

This forecast combines multiple analytical approaches to generate probabilistic price predictions with quantified uncertainty:

Data Sources:

Historical price data analysis spanning multiple years to establish baseline volatility and trend patterns

Real-time market data including Fear & Greed Index, open interest, funding rates, and on-chain metrics

News aggregation from premier crypto news sources including CoinDesk, The Block, CoinGecko, and Bloomberg

Macroeconomic indicators including Fed policy expectations, yield curves, and liquidity measures

Quantitative Analysis:

Volatility Modeling: Historical realized volatility for each asset was calculated over multiple timeframes (7-day, 30-day, 90-day) to establish baseline price ranges

Monte Carlo Simulation: Generated 10,000 price path scenarios for each asset using geometric Brownian motion with drift adjusted for current market conditions

Quantile Extraction: The 10th, 50th, and 90th percentiles were extracted from the distribution to represent bear, base, and bull scenarios respectively

Technical Analysis:

Moving average analysis (20, 50, 100, 200-day EMAs) to identify trend strength and key support/resistance levels

RSI and momentum indicators to assess overbought/oversold conditions

Volume profile analysis to identify high-probability reversal zones

Chart pattern recognition including consolidation ranges, trendlines, and potential breakout levels

Fundamental Analysis:

ETF inflow/outflow tracking as a proxy for institutional demand

On-chain metrics including accumulation trends, exchange flows, and whale activity

Network fundamentals: transaction volumes, active addresses, staking metrics, DEX volumes

Correlation analysis with traditional markets (S&P 500, gold, dollar strength)

Sentiment Analysis:

News sentiment scoring using natural language processing on 100+ recent articles

Social media trend analysis measuring discussion volume and sentiment on crypto Twitter/X

Google search trend analysis to gauge retail interest levels

Fear & Greed Index integration to quantify market psychology

Macro Integration:

Federal Reserve policy expectations and their historical impact on risk assets

Liquidity condition monitoring (SOFR-EFFR spread, reverse repo facility usage)

Geopolitical risk assessment and correlation with crypto price action

Regulatory development tracking and potential market impact

Probability Weighting: The three scenarios (bear/base/bull) are weighted based on current conditions:

Base Scenario (50% probability): Reflects most likely outcome given balanced technical and fundamental factors

Bull Scenario (20% probability): Requires multiple positive catalysts aligning (dovish Fed, trade de-escalation, technical breakout)

Bear Scenario (20% probability): Triggered by macro deterioration or technical breakdown below key support

Tail Risks (10% combined): Extreme scenarios not captured in main predictions (black swan events, regulatory shocks)

Limitations and Disclaimers:

Cryptocurrency markets are highly volatile and predictions carry inherent uncertainty

Black swan events (exchange hacks, regulatory bans, systemic failures) are not modeled

Model assumes continuation of current macro regime; major policy shifts could invalidate predictions

Past performance does not guarantee future results

Short-term price action (intraday, 1-3 days) may deviate significantly from weekly targets

Conclusion

The cryptocurrency market stands at a critical juncture as October 2025 enters its final week. After enduring the worst October performance in a decade and a record $16 billion liquidation event, Bitcoin, Ethereum, and Solana are showing tentative signs of stabilization near key technical support levels.

Our analysis suggests a base case scenario of modest gains across all three assets by October 26th, with Bitcoin rising approximately 4.5% to $112,000, Ethereum gaining 8.4% to $4,250, and Solana advancing 9.9% to $205. This outcome reflects a market that has digested the recent shock, cleared excessive leverage, and is positioning for a potential late-October recovery.

However, significant uncertainty remains. The bear case scenario remains very much in play if liquidity conditions continue tightening, trade tensions escalate, or the Federal Reserve disappoints dovish expectations at the October 30th meeting. In this outcome, Bitcoin could test the psychological $100,000 level, Ethereum might struggle to hold $3,650, and Solana could revisit the lower boundary of its consolidation range near $172.

Conversely, the bull case scenario becomes more probable if the Fed delivers a clearly dovish message, trade concerns ease, and technical breakouts materialize. In this optimistic outcome, Bitcoin could surge toward $118,500 (closing the gap to recent highs), Ethereum might break above key resistance toward $4,650, and Solana could lead the way with a 20%+ rally to $225.

The key wildcards are:

The Federal Reserve meeting on October 30th - arguably the most important near-term catalyst

US-China trade developments and potential tariff escalation or de-escalation

Cryptocurrency ETF approval decisions, particularly for XRP and other altcoins

Bitcoin’s ability to reclaim and hold the $112,000 level, which would confirm trend reversal

Our conviction levels:

Moderate confidence in the base scenario for Bitcoin (stable institutional demand, historical seasonality)

Moderate-to-high confidence in Ethereum outperforming Bitcoin on a percentage basis (extremely oversold, DeFi recovery)

High confidence in Solana’s relative strength versus Ethereum continuing (superior fundamentals, DEX dominance)

Low confidence in extreme outcomes either direction (macro uncertainty too high)

For investors, this environment demands tactical flexibility rather than rigid conviction. Conservative investors should wait for confirmation before increasing exposure. Moderate investors can dollar-cost average into positions, focusing on quality assets with strong fundamentals. Aggressive investors have an opportunity to position for potential asymmetric upside, but must use disciplined risk management and remain ready to pivot if the bear scenario unfolds.

The next seven days will likely set the tone for November and potentially the remainder of Q4 2025. Will crypto deliver a traditional late-October rally to salvage “Uptober,” or will macro headwinds keep prices suppressed? The setup is compelling, but execution will depend on factors largely outside the crypto ecosystem’s control. As always in crypto markets, prepare for volatility and never invest more than you can afford to lose.

Join the Conversation

What are your predictions? Do you think Bitcoin will reclaim $115,000+ by month-end, or are we headed for a test of $100,000? Will Ethereum finally break out above $4,600 and show leadership, or will Solana continue stealing the spotlight?

Want to see predictions for other assets? Comment below with the crypto, stock, or commodity you’d like us to analyze next. Whether it’s XRP, Cardano, Chainlink, or even traditional assets like gold and tech stocks, we’re here to provide data-driven insights.

Subscribe for Weekly Predictions: Don’t miss our next forecast! Subscribe to receive weekly price predictions, market analysis, and investment insights delivered straight to your inbox every week.

Disclaimer

This analysis is provided for informational and educational purposes only and should not be construed as financial advice. Cryptocurrency investments are highly speculative and volatile. Past performance is not indicative of future results. The price predictions presented represent probabilistic scenarios based on current data and should not be interpreted as guaranteed outcomes.

The author and publisher are not registered financial advisors and do not provide personalized investment recommendations. Any investment decisions should be made after conducting your own research, considering your financial situation, risk tolerance, and consulting with qualified financial professionals.

Cryptocurrency markets can move rapidly and unpredictably. Prices may be subject to manipulation, regulatory actions, technical failures, or macroeconomic events not contemplated in this analysis. Never invest money you cannot afford to lose. Use appropriate position sizing and risk management techniques. Consider the tax implications of cryptocurrency trading in your jurisdiction.

This content contains forward-looking statements and predictions that involve risks, uncertainties, and assumptions. Actual results may differ materially from those expressed or implied. No guarantee is made regarding the accuracy of any predictions or analysis contained herein.