Crypto Price Predictions: October 13-19, 2025

Bitcoin, Ethereum, Solana and XRP price forecast for this week

Executive Summary

Current Market Snapshot (October 13, 2025)

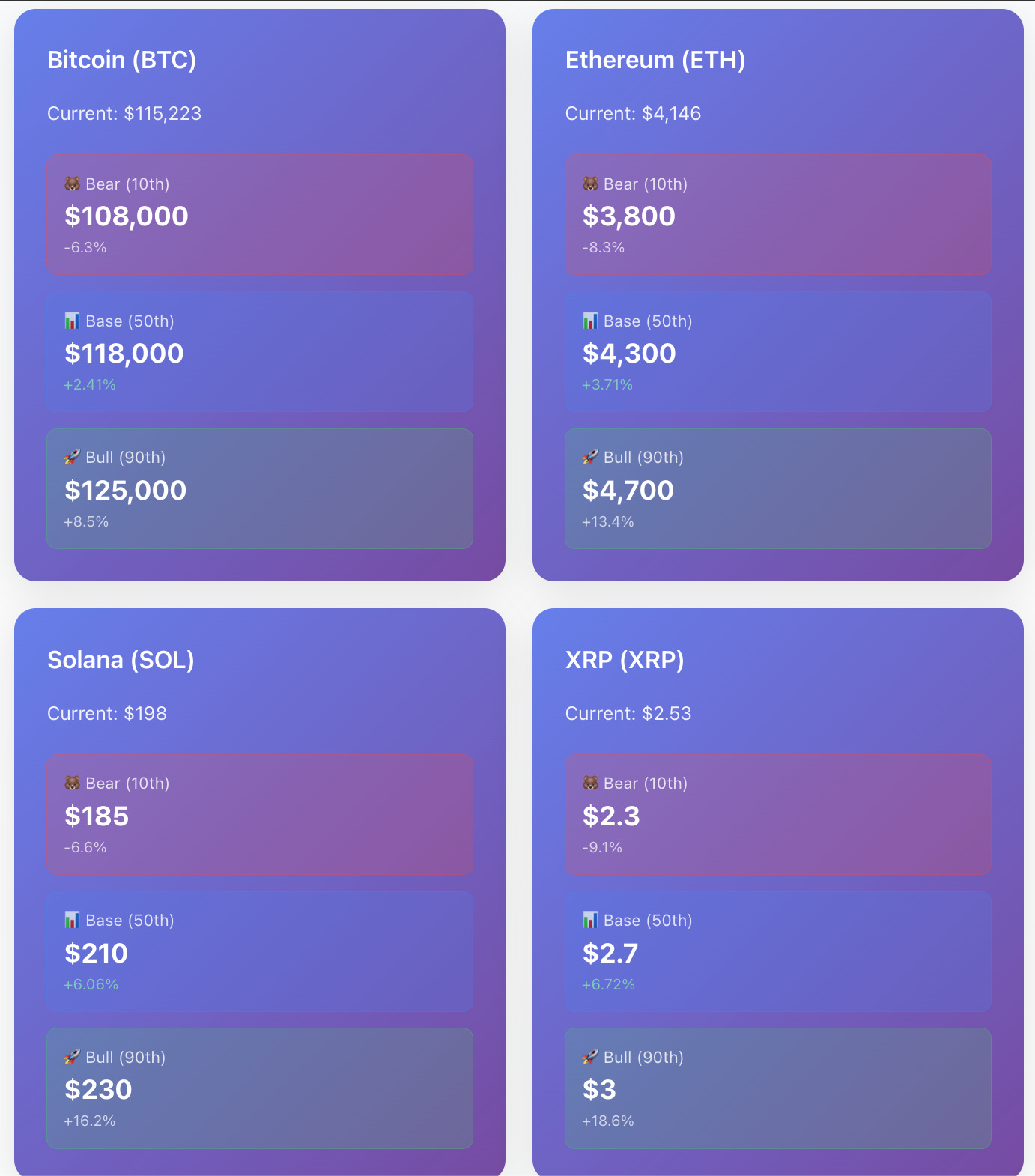

Bitcoin (BTC): $115,223 | Ethereum (ETH): $4,146 | Solana (SOL): $198 | XRP: $2.53

October 19, 2025 Price Predictions

Bitcoin (BTC)

🐻 Bear (10th %ile): $108,000 (-6.3%)

📊 Base (50th %ile): $118,000 (+2.4%)

🚀 Bull (90th %ile): $125,000 (+8.5%)

Ethereum (ETH)

🐻 Bear: $3,800 (-8.3%)

📊 Base: $4,300 (+3.7%)

🚀 Bull: $4,700 (+13.4%)

Solana (SOL)

🐻 Bear: $185 (-6.6%)

📊 Base: $210 (+6.1%)

🚀 Bull: $230 (+16.2%)

XRP

🐻 Bear: $2.30 (-9.1%)

📊 Base: $2.70 (+6.7%)

🚀 Bull: $3.00 (+18.6%)

Key Takeaway

The crypto market is navigating a critical bottoming phase after a sharp correction from October’s record highs. All four major assets show potential for modest recovery in the base case scenario, with XRP and Solana offering the highest upside potential driven by upcoming ETF decisions and ecosystem growth. Bitcoin remains the most stable with lower volatility, while the market awaits clarity on macro conditions and regulatory developments.

Recent Market Context

The October Rally and Correction

October 2025 began with exceptional strength as Bitcoin surged to an all-time high of $126,080 on October 6, driven by what market participants dubbed the “Uptober” phenomenon. This rally was characterized by several key factors: record institutional ETF inflows exceeding $1.19 billion in a single day, strong on-chain accumulation patterns, and over 90 public companies now holding Bitcoin on their balance sheets worth $113 billion collectively.

The euphoria was short-lived. On October 10, the market experienced its largest liquidation event ever, with $16 billion in leveraged long positions forcibly closed across all major cryptocurrencies. Bitcoin plunged from $124,000 to $113,000 within hours, while Ethereum dropped 11% and altcoins suffered 20-40% corrections. This cascade was triggered by overleveraged positions, Federal Reserve comments on interest rate policy, and the ongoing US government shutdown delaying critical economic data releases.

Current Market Positioning

As of October 13, the market is in a multi-phase bottoming process. Trading volumes remain elevated at $198 billion daily, indicating active market participation despite the correction. Bitcoin dominance has climbed to 59.4%, its highest level since August, as traders rotate capital to safer crypto assets during uncertainty. The Fear & Greed Index has cooled from 62 (greed) to 57 (neutral), reflecting more cautious sentiment while avoiding extreme fear territory.

Market makers are currently engaged in arbitrage activities to resolve price discrepancies between spot and futures markets, a technical process that typically prevents immediate V-shaped recoveries. This suggests a gradual stabilization rather than rapid bounce-back is more likely in the near term.

Rationale and Key Factors

Bullish Factors (Supporting Recovery)

Institutional Momentum Remains Intact

Despite the correction, institutional adoption shows no signs of slowing. US Bitcoin ETFs have accumulated over $61.25 billion in net inflows since launch, with Ethereum ETFs reaching $14.6 billion. Corporate treasury adoption continues expanding internationally, with Japan’s Metaplanet becoming the fourth-largest corporate holder, explicitly modeling its strategy after MicroStrategy’s playbook. This institutionalization provides fundamental support that didn’t exist in previous crypto cycles.

Strategic ETF Catalyst Window

October 18-25 marks a critical period with eight XRP ETF decisions expected from the SEC. These applications come from asset management giants like Grayscale, WisdomTree, and Franklin Templeton, collectively managing over $8 trillion. Analysts project $3-5 billion in first-year inflows could double XRP’s market cap. Similarly, Solana ETF speculation intensified with applications for spot products featuring staking components, which could unlock institutional demand for yield-generating crypto exposure.

Technical Reset Creates Opportunity

The recent liquidation event cleared excessive leverage from the system, resetting technical indicators to healthier levels. Ethereum’s RSI reached its most oversold reading since April 2025, a condition that historically preceded a 134% rally over two months. Bitcoin reclaimed all major exponential moving averages, suggesting the uptrend structure remains intact despite the pullback. On-chain metrics show accumulation zones activating, indicating sophisticated investors are positioning for the next leg up.

Seasonal Historical Strength

October has posted positive returns in 11 of the past 15 years for Bitcoin, with the last six consecutive Octobers closing green with an average gain of 27%. Q4 historically represents the strongest quarter for crypto assets, with Bitcoin averaging 24% gains and Ethereum posting 24% increases. This seasonal pattern, combined with year-end portfolio rebalancing and tax-loss harvesting creating buying pressure, supports optimistic scenarios.

Macro Environment Evolution

The US government shutdown, paradoxically, has driven interest in Bitcoin as a “debasement trade” hedge against fiscal uncertainty. VanEck analysts project Bitcoin could reach half of gold’s market capitalization, implying a $644,000 target price as younger investors in emerging markets increasingly prefer digital over physical precious metals. With gold hitting record highs, the digital gold narrative gains credibility.

Bearish Risks (Downside Factors)

Persistent Macro Headwinds

Federal Reserve Governor Stephen Miran’s recent comments shifting his neutral rate view from high to 0.5% signal tighter monetary conditions may persist longer than anticipated. Tighter immigration policy reducing labor supply and rising fiscal deficits complicate the Fed’s inflation-employment balancing act, potentially limiting room for rate cuts that typically benefit risk assets. Without accommodative policy, crypto faces headwinds.

Overextended Leverage Still Unwinding

While $16 billion liquidated, derivatives open interest across centralized exchanges still stands at $187 billion, and perpetual funding rates remain elevated. The week before the crash saw the strongest BTC accumulation of 2025 at 63,083 BTC, driven by widespread long positioning without clear fundamental catalysts. This suggests additional deleveraging could occur if macro conditions worsen or if key support levels break.

Government Shutdown Uncertainty

The ongoing US government shutdown has delayed critical economic data releases, including employment reports, creating an information vacuum that increases market volatility. This uncertainty affects risk asset pricing broadly and could trigger additional selloffs if shutdown extends or if delayed data reveals economic weakness when eventually released.

Regulatory and Geopolitical Risks

US-China trade tensions mentioned in market commentary could escalate, creating broader risk-off sentiment. While crypto ETF approvals have progressed, the SEC remains in wait-and-see mode during the shutdown, potentially delaying expected altcoin ETF decisions. Any regulatory setback could disappoint markets positioned for positive catalysts.

Technical Support Tests

Bitcoin must hold the $114,000-115,000 zone to maintain bullish structure. A break below could trigger another leg down to $108,000-110,000. Similarly, Ethereum needs to defend $4,000, Solana $185, and XRP $2.30 to avoid deeper corrections. Given the recent volatility, these support levels remain vulnerable to headline-driven selling.

Key Events to Watch

Week of October 18-25: SEC decisions on eight XRP ETF applications. Approval could trigger institutional inflows and price spike; rejection would be bearish.

End of October: Federal Reserve meeting with potential rate decision, though delayed economic data complicates their analysis.

Ongoing: US government shutdown resolution or extension. Prolonged shutdown increases uncertainty; resolution could restore confidence.

Technical Levels: BTC $121,000 breakout would signal renewed strength toward $125,000-$130,000; failure below $114,000 risks decline to $108,000-$110,000.

Derivatives Funding Rates: Watch for normalization in perpetual funding rates as sign of healthier market structure.

Investment Implications

For Conservative Investors

Conservative investors should prioritize capital preservation with limited exposure to crypto’s inherent volatility. Consider allocating no more than 5-10% of portfolio to Bitcoin specifically, as it exhibits the lowest volatility among the four assets and has the deepest institutional backing. Dollar-cost averaging (DCA) into positions over the next 2-3 weeks allows you to capture potential upside while avoiding concentration risk from timing the bottom perfectly.

Given the current correction phase, patience is paramount. Use the 10th percentile (bear) scenarios as entry points: BTC $108,000, ETH $3,800. Set strict stop-losses 5-7% below entry to limit downside. Avoid altcoins entirely or limit to 1-2% allocation in established assets like Ethereum. This approach balances participation in crypto’s long-term growth story while protecting against further near-term downside.

Consider Bitcoin as digital gold diversification rather than speculation. The institutional adoption trend provides fundamental support, but the asset class remains in price discovery. Rebalance quarterly and maintain discipline to avoid emotional decisions during volatility spikes.

For Moderate Investors

Moderate investors can pursue a 60/40 split between Bitcoin and select altcoins, with 15-20% total portfolio allocation to crypto. Bitcoin should comprise 60% of crypto holdings given its relative stability and liquidity advantages. Allocate the remaining 40% across Ethereum (20%), Solana (10%), and XRP (10%) to capture higher growth potential while maintaining diversification.

The current market structure presents a compelling risk-reward setup for moderate investors. Accumulate positions in tranches: 40% of intended allocation immediately, 30% if prices test bear scenarios, and 30% reserved for breakout confirmation above key resistance levels. This strategy captures immediate opportunity while maintaining dry powder for various market outcomes.

Focus on projects with real utility and institutional interest. Ethereum’s DeFi dominance and upcoming Layer-2 scaling improvements provide fundamental backing. Solana’s transaction volume exceeding Ethereum and potential ETF approval offer asymmetric upside. XRP’s ETF decisions could create transformational moment. These catalysts justify higher allocations than pure speculation.

Set price targets and take partial profits: scale out 25-30% of positions at 50th percentile predictions, another 25% at 75th percentile levels. Let remaining position run with trailing stops at 20%. This disciplined approach locks in gains while maintaining exposure to potential further upside. Review positions monthly and adjust based on macro conditions and project developments.

For Aggressive Investors

Aggressive investors seeking maximum returns can embrace higher concentration and leverage, accepting corresponding downside risk. Consider 30-40% total portfolio allocation to crypto with weighted distribution: BTC 30%, ETH 25%, SOL 25%, XRP 20%. This overweight in higher-volatility altcoins targets outsized gains during recovery phases that typically see altcoins outperforming Bitcoin by 2-3x.

The October correction created attractive entry points rarely seen at major support levels. Deploy 60% of intended capital immediately to capture the bottoming process, with 40% reserved for averaging down if bear scenarios materialize. Given your risk tolerance, focus on the 50th-90th percentile outcome range rather than downside protection.

Consider strategic use of leverage through crypto-backed lending protocols or futures with 1.5-2x leverage maximum. Current funding rate reset makes leveraged longs cheaper than during the overheated rally. However, use extremely tight risk management: stop losses at 12-15% below entry, position sizing to ensure no single trade exceeds 10% of crypto allocation.

Tactical trading opportunities abound in current volatility. XRP presents an asymmetric bet ahead of ETF decisions with potential 20-40% move in either direction. Options strategies like buying call spreads targeting 90th percentile outcomes while selling covered calls against spot positions can generate yield while capping upside. Solana’s ETF speculation offers similar dynamics with less correlation to Bitcoin.

Target price levels: Exit 20% of positions at base scenarios, 30% at 75th percentile, 30% at 90th percentile, and trail remaining with 25% stops from peaks. In bull scenario realization, add to positions on strength with new capital. Most importantly, monitor macro conditions and regulatory developments religiously—aggressive positions require active management and willingness to pivot quickly when thesis changes.

Methodology

Data Sources and Analysis Framework

This forecast synthesizes multiple data streams analyzed through quantitative and qualitative frameworks. Historical price data was sourced from Alpha Vantage covering daily OHLCV (Open, High, Low, Close, Volume) for all four cryptocurrencies from October 2024 through October 13, 2025. This 12-month window captures the full bull market cycle including the August 2025 previous all-time high and subsequent consolidation.

Recent market sentiment and news analysis incorporated articles from CoinDesk, Bloomberg, Cryptonews, and The Block published between October 5-12, 2025. These sources provided context on the record high rally, institutional flows, $16 billion liquidation event, Federal Reserve commentary, and upcoming regulatory catalysts. On-chain metrics including Bitcoin dominance, derivatives open interest, and liquidation data were sourced from Glassnode and CoinGlass.

Quantile Prediction Approach

The forecast employs quantile regression methodology to capture uncertainty inherent in cryptocurrency price prediction. Rather than point estimates, we project three scenarios corresponding to the 10th, 50th (median), and 90th percentiles of potential outcomes. This approach acknowledges crypto’s high volatility while providing decision-relevant information for investors with different risk tolerances.

The 10th percentile (bear) scenario reflects conditions where multiple negative factors materialize: extended government shutdown, Federal Reserve hawkishness, continued liquidations, and breakdown of technical support levels. Historical volatility analysis of similar market corrections informed downside magnitude estimates.

The 50th percentile (base) scenario assumes current conditions persist with gradual stabilization, modest recovery, and mixed macro signals. This represents the most likely path given historical precedent of crypto corrections requiring 1-2 weeks to form bottoms before resuming trends. Technical indicators suggest support levels will hold with testing but not breaking.

The 90th percentile (bull) scenario envisions positive catalyst convergence: XRP ETF approvals, Solana ETF optimism, Fed pivot signals, government shutdown resolution, and technical breakouts above resistance. While less probable, this scenario has historical precedent—Bitcoin’s October 2024 gained 40% in similar conditions.

Technical and Fundamental Integration

Technical analysis examined support/resistance levels, moving averages, RSI readings, volume patterns, and historical seasonal performance. Fundamental analysis weighted institutional adoption trends, regulatory catalyst timelines, on-chain accumulation signals, and macroeconomic policy impacts. The integration of both approaches provides more robust forecasts than either in isolation.

Limitations and Uncertainties

Cryptocurrency markets exhibit extreme volatility and sensitivity to unpredictable events—regulatory announcements, security breaches, macroeconomic shocks, or technological developments can instantly invalidate forecasts. The short 7-day forecast window reduces but doesn’t eliminate this uncertainty. Past performance, while informative, doesn’t guarantee future results, particularly in an asset class with limited historical data. The ongoing government shutdown creates exceptional uncertainty in macro data that normally anchors analysis. These predictions should be treated as probabilistic scenarios rather than definitive outcomes, and investors should conduct ongoing monitoring and be prepared to adjust positions as new information emerges.

Conclusion

The week of October 13-19, 2025 represents a pivotal moment for cryptocurrency markets as they navigate the aftermath of history’s largest liquidation event while positioned at critical technical and fundamental inflection points. Our analysis suggests a most likely path toward modest recovery, with Bitcoin targeting $118,000, Ethereum $4,300, Solana $210, and XRP $2.70 by week’s end—representing 2-7% gains across the board as markets stabilize and digest recent volatility.

However, the risk-reward balance tilts favorably for those with appropriate risk tolerance. The bullish scenario offers 9-19% upside potential driven by upcoming XRP ETF decisions, Solana ecosystem strength, Ethereum’s technical oversold condition, and Bitcoin’s institutional support. These catalysts could materialize quickly, particularly if the October 18-25 ETF decision window brings positive surprises or if macro uncertainty resolves constructively.

The key for investors is matching strategy to risk profile while maintaining flexibility. Conservative investors should focus on Bitcoin accumulation at attractive levels with strict risk management. Moderate investors can pursue diversified exposure capturing altcoin upside while anchored by Bitcoin stability. Aggressive investors have compelling tactical opportunities but must actively manage positions given elevated volatility.

Ultimately, the correction has reset the market to healthier levels, clearing excessive leverage and positioning crypto for the traditionally strong Q4 period. While near-term volatility persists, the fundamental case for digital assets—institutional adoption, regulatory progress, and technological advancement—remains intact. The coming week will provide crucial signals about whether October 2025 lives up to its “Uptober” reputation or requires additional consolidation before the next major leg higher.

What’s your prediction for crypto prices this week? Do you think we’ll see the bear, base, or bull scenario play out? Are you positioning for XRP’s ETF decisions or Solana’s ecosystem growth?

Share your thoughts in the comments below! I’m particularly interested in hearing:

Which asset you’re most bullish/bearish on and why

Your take on the $16B liquidation event—healthy reset or warning sign?

How you’re managing portfolio allocations in this volatile environment

Want more detailed predictions on other cryptocurrencies? Let me know which assets you’d like analyzed next! ADA? DOT? AVAX? BNB? I’ll create custom forecasts based on your requests.

Subscribe to receive weekly crypto price predictions delivered straight to your inbox every Sunday night, including technical analysis, on-chain metrics, and institutional flow data. Don’t miss the next market-moving catalyst!

Disclaimer

This report is provided for informational and educational purposes only and does not constitute financial, investment, trading, or any other type of advice. The cryptocurrency market is highly speculative and volatile, and past performance is not indicative of future results.

The predictions and analysis contained herein represent opinions and estimates based on current market conditions, historical data, and available information as of October 13, 2025. These projections involve inherent risks and uncertainties, and actual outcomes may differ materially from forecasts presented.

Nothing in this report should be construed as a recommendation to buy, sell, or hold any cryptocurrency or digital asset. Investors should conduct their own due diligence, consult with qualified financial advisors, and carefully consider their individual financial situation, risk tolerance, and investment objectives before making any investment decisions.

Cryptocurrency investments carry substantial risk of loss, and you should only invest funds you can afford to lose. The author assumes no responsibility for any losses or damages resulting from reliance on information provided in this report.