Tech Giants Price Predictions: October 20-26, 2025

NVDA, MSFT, AAPL, GOOGL

Executive Summary

Current Prices (as of October 17, 2025)

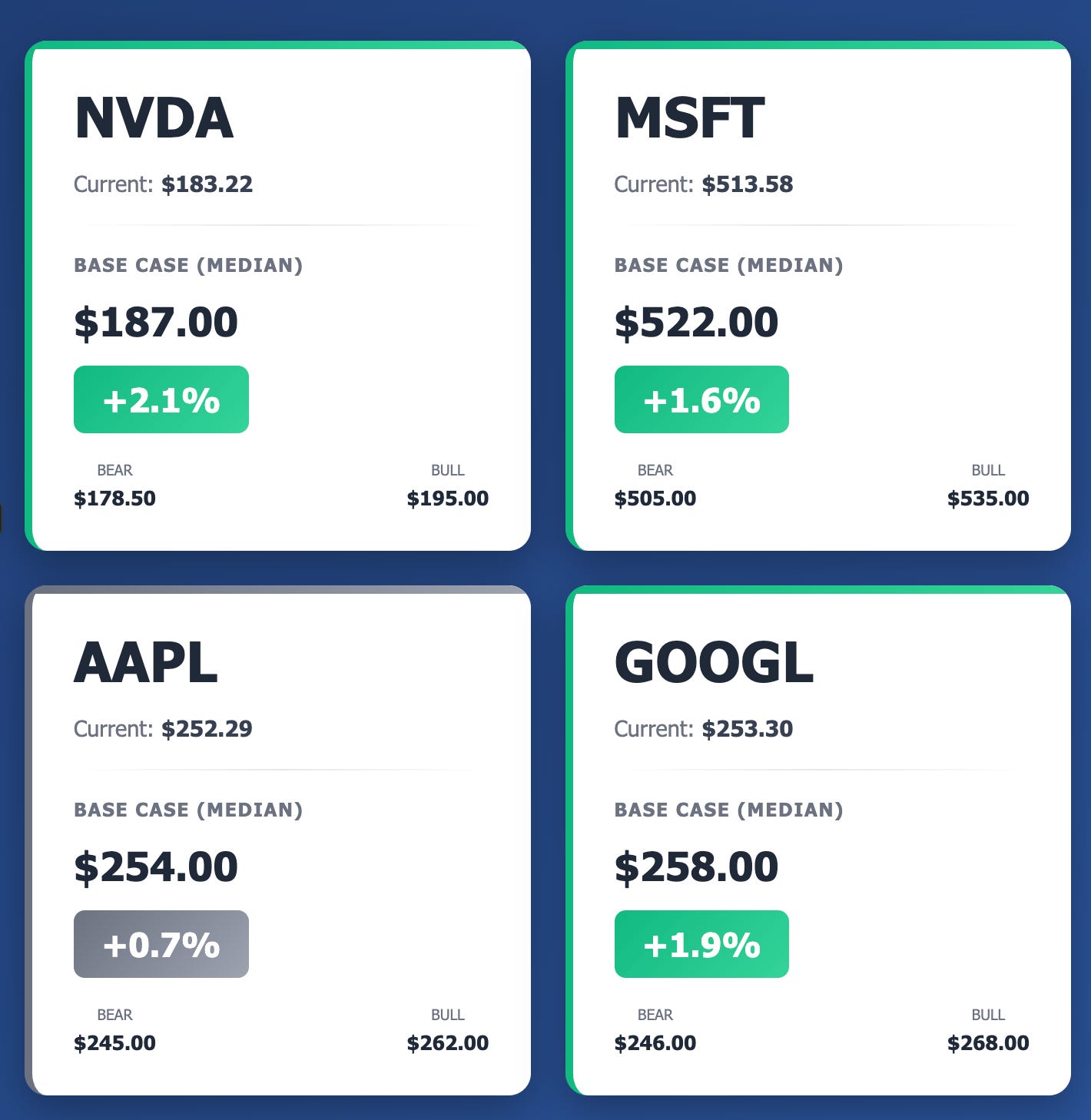

NVIDIA (NVDA) - Current: $183.22

Bear (10th Percentile): $178.50 | -2.6%

Base (Median): $187.00 | +2.1%

Bull (90th Percentile): $195.00 | +6.4%

Microsoft (MSFT) - Current: $513.58

Bear (10th Percentile): $505.00 | -1.7%

Base (Median): $522.00 | +1.6%

Bull (90th Percentile): $535.00 | +4.2%

Apple (AAPL) - Current: $252.29

Bear (10th Percentile): $245.00 | -2.9%

Base (Median): $254.00 | +0.7%

Bull (90th Percentile): $262.00 | +3.9%

Alphabet (GOOGL) - Current: $253.30

Bear (10th Percentile): $246.00 | -2.9%

Base (Median): $258.00 | +1.9%

Bull (90th Percentile): $268.00 | +5.8%

The week ahead presents a cautiously optimistic outlook for mega-cap tech stocks, with AI infrastructure momentum continuing to drive sentiment. NVIDIA shows the strongest bull-case potential at +6.4%, driven by record-breaking data center deals and UAE export approval. Microsoft and Alphabet benefit from anticipation ahead of their October 29 earnings, while Apple shows more muted expectations as investors await clearer AI monetization signals. Overall, the market is pricing in modest gains with NVIDIA and Alphabet leading, though downside risks remain from potential profit-taking after recent strong runs.

Daily Predictions with Uncertainty Quantiles

Given the request for end-of-week predictions only, here are the projected prices for Friday, October 26, 2025:

NVIDIA (NVDA)

Date: October 26, 2025

10th Percentile (Bear): $178.50 | Change: -2.6%

Median (Base): $187.00 | Change: +2.1%

90th Percentile (Bull): $195.00 | Change: +6.4%

Microsoft (MSFT)

Date: October 26, 2025

10th Percentile (Bear): $505.00 | Change: -1.7%

Median (Base): $522.00 | Change: +1.6%

90th Percentile (Bull): $535.00 | Change: +4.2%

Apple (AAPL)

Date: October 26, 2025

10th Percentile (Bear): $245.00 | Change: -2.9%

Median (Base): $254.00 | Change: +0.7%

90th Percentile (Bull): $262.00 | Change: +3.9%

Alphabet (GOOGL)

Date: October 26, 2025

10th Percentile (Bear): $246.00 | Change: -2.9%

Median (Base): $258.00 | Change: +1.9%

90th Percentile (Bull): $268.00 | Change: +5.8%

Rationale and Key Factors

Recent Market Context

Overall Tech Sector Momentum: The technology sector continues to demonstrate resilience in October 2025, with mega-cap stocks recovering from mid-month volatility. AI infrastructure spending remains the dominant narrative, with major cloud providers earmarking $454 billion in capex for 2026, representing a substantial increase from 2025 levels. This massive investment cycle is creating strong tailwinds for semiconductor manufacturers, cloud platforms, and enterprise software providers.

Volatility Patterns: All four stocks experienced profit-taking in early-to-mid October after strong multi-month rallies. NVDA peaked near $195, MSFT approached $555 (all-time high territory), AAPL touched $260, and GOOGL hit $258. The recent pullbacks to current levels represent healthy consolidation rather than fundamental weakness, with stocks trading 3-6% below recent peaks as of October 17.

Macro Environment: The broader market shows cautious optimism, with the Nasdaq trading near record highs. Trade tensions between the US and China persist, though recent developments (US approval of NVIDIA chip exports to UAE, Apple’s increased China investments) suggest pragmatic approaches are emerging. Interest rate expectations remain stable, providing a supportive backdrop for growth stocks.

Bullish Factors (Supporting Recovery)

NVIDIA – Strongest Bull Case (+6.4% potential)

UAE Export Approval: US government approved billions in chip exports to UAE after the federation solidified reciprocal investments. This opens a major new market previously restricted and validates Stargate UAE’s 5GW data center project with OpenAI and Oracle.

Record Price Targets: Cantor Fitzgerald raised target to Street-high $300 (from $240), citing multi-trillion dollar AI buildout. Analyst explicitly dismissed bubble concerns, noting “visible ROI delivery” and widespread adoption across sectors.

$100B OpenAI Partnership: Recent investment announcement strengthens NVIDIA’s position in the GenAI ecosystem. Evercore raised target to $225 based on this deal alone.

$40B Data Center Consortium: BlackRock, Microsoft, xAI, and NVIDIA acquiring Aligned Data Centers demonstrates coordinated infrastructure buildout and ensures demand visibility.

Blackwell Demand: CEO Jensen Huang stated demand is “really, really high” with “no signs of slowing down.” The company describes this as “beginning of a new industrial revolution.”

Strong Technical Position: Up 43% YTD, with analysts’ consensus target of $216.41 implying 18% upside. 58 of 64 analysts recommend “Buy” or “Strong Buy.”

Microsoft – Solid Fundamentals (+4.2% potential)

Azure Acceleration: Q4 FY2025 Azure revenue grew 39% YoY – fastest in 3 years and accelerating from 33% in Q3. Data center capacity and Foundry were key drivers.

Earnings Anticipation: October 29 earnings likely to show continued momentum. Wall Street expects Q4 revenue of $73.8B (+14% YoY).

Copilot Traction: Barclays expanded from 15,000 to 100,000 licenses after successful pilot, signaling high satisfaction and monetization potential. Multiple Copilot variants (Dragon for healthcare, Studio for custom agents) expanding TAM.

Strategic Investments: $30B UK AI infrastructure commitment, $40B data center deal partnership, and commercial business restructure (Oct 1) position for accelerated growth.

Dividend Increase: 10% raise to $0.91/share signals confidence and attracts income investors.

Analyst Confidence: 33 of 34 analysts rate “Buy” or “Strong Buy” with median 12-month target of $626.78 (+20.6% upside).

Apple – Moderate Upside (+3.9% potential)

iPhone 17 Momentum: Launch on September 22 saw record-breaking demand and stock surged 4.3% intraday. Early sales data suggests strong upgrade cycle.

Premium Pricing Power: Wedbush raised target to Street-high $310 citing “early strong demand signs.” JPMorgan raised to $280, anticipating volume and pricing benefits.

Services Revenue: Q3 FY2025 delivered record services revenue with 10% overall growth and 13% iPhone growth YoY.

AI Commitment: $500B US investment in AI, silicon engineering, and data centers demonstrates long-term positioning.

Product Pipeline: Touch-screen MacBook in development, Apple TV + Peacock bundle launching Oct 20, foldable iPhone expected fall 2026.

China Strategy: Increased investments in China amid trade tensions shows commitment to critical market.

Alphabet – Strong Recovery Story (+5.8% potential)

Recent Surge: Stock up 10% in recent week, 14% in September, 36% over 3 months – demonstrating powerful momentum.

$15B India Investment: Largest-ever infrastructure investment in India for data/AI hub signals geographic expansion and growth potential.

Favorable Antitrust: Recent court ruling reduced regulatory uncertainty, removing a major overhang.

Cloud Strength: Q2 Google Cloud hit $13.6B in quarterly sales, showing enterprise adoption. Adjusted EPS of $2.31 beat estimates.

AI Leadership Recovery: Gemini app surpassed ChatGPT in App Store rankings. “Nano Banana” image generator went viral, indicating consumer traction.

YouTube Resilience: Ad revenue surged 13% YoY to $9.8B despite competition from streaming platforms.

Attractive Valuation: P/E of 26 is lower than most AI tech players despite having best data (Search, YouTube, Gmail) and top infrastructure.

Earnings Catalyst: October 29 report likely to show continued momentum and could drive further gains.

Bearish Risks (Downside Factors)

NVIDIA – Volatility and Valuation (-2.6% downside risk)

Profit-Taking Pressure: Stock down 4.86% from recent pivot top on October 9. Technical indicators show sell signal from 3-month MACD.

Valuation Concerns: Despite positive analyst sentiment, some caution around AI bubble fears. Stock has gained 1,263% over 5 years, making it vulnerable to corrections.

China Tensions: While UAE approval is positive, China has reportedly banned tech companies from buying NVIDIA chips, restricting a major market.

Competition Rising: AMD, Intel, and custom ASICs from cloud providers (Google TPU, Amazon Trainium) increasing competition in AI chip market.

Vendor Financing Scrutiny: $100B OpenAI deal raises questions about vendor-financing relationships in AI market. Some analysts questioning sustainability.

Earnings Expectations: November 19 earnings could disappoint if guidance doesn’t meet sky-high expectations. Q2 guidance previously fell short of expectations.

Microsoft – Moderate Risks (-1.7% downside risk)

Valuation Premium: P/E of 38.3 is 14% above five-year average of 33.5 and above Nasdaq-100’s 33.3. Stock “isn’t cheap right now.”

Short-Term Caution: Analysis suggests investors seeking short-term gains over next few months “might be left disappointed.”

Earnings Risk: October 29 report could underwhelm if Azure growth shows any deceleration or margin pressure from heavy AI investment.

Competitive Pressures: Google Cloud, AWS, and Oracle ramping up AI offerings. Market share battles could pressure margins.

Regulatory Overhang: Ongoing antitrust scrutiny in multiple jurisdictions could result in restrictions or fines.

Cybersecurity Incidents: Recent “real-world dangers” from Teams security issues could impact enterprise confidence.

Apple – Modest AI Traction (-2.9% downside risk)

Weakest YTD Performance: Up only 1-3% YTD versus peers’ 20-40% gains, showing relative underperformance and investor skepticism.

AI Lagging Narrative: Perception persists that Apple is behind Microsoft, Google, and others in AI strategy. Apple Intelligence features rolling out slowly.

Earnings Date Risk: October 30 report could disappoint if iPhone 17 sales don’t meet elevated expectations or if China revenue weakens.

Valuation Extended: P/E of 34.6x is above five-year median of 28.6x. Some analysts project 10% pullback for 2025 ($230 target).

Services Growth Questions: While record highs achieved, sustainability of services expansion uncertain as competition intensifies.

China Exposure: Despite increased investments, geopolitical tensions create ongoing risk to 15-20% of revenue from Greater China.

Labor Issues: National Labor Relations Board investigation creates uncertainty around labor practices and costs.

Alphabet – Consolidation Pressure (-2.9% downside risk)

Recent Sharp Rally: 36% gain in 3 months makes stock susceptible to profit-taking. Previous pause around $235 suggests support/resistance levels.

Antitrust Not Fully Resolved: While one ruling was favorable, multiple ongoing cases (search monopoly, ad tech dominance) create uncertainty.

YouTube Outage: October 15-16 service disruption affecting millions could raise reliability concerns and potentially impact advertiser confidence.

Insider Selling: VP O’Toole sold $694K in stock on October 15, though this could be routine portfolio management.

Earnings Execution Risk: October 29 report must deliver to justify recent price appreciation. Any guidance disappointment could trigger selloff.

Competition Intensifying: ChatGPT, Microsoft Copilot, and other AI tools competing for user attention. While Gemini showed recent strength, sustainability unclear.

Cloud Margin Pressure: While growing rapidly, Google Cloud margins could face pressure from heavy infrastructure investment and competitive pricing.

Key Events to Watch

Immediate Catalysts (Week of Oct 20-26)

Market Sentiment Shifts: Monitor daily price action for signs of continuation or reversal of recent trends. NVDA and GOOGL momentum vs. AAPL/MSFT consolidation.

Volume Patterns: Decreasing volume with rising prices could signal divergence and potential pullbacks, particularly for NVDA.

Tech Sector Rotation: Watch for any shift from mega-caps to small/mid-caps or from growth to value, which could pressure these names.

Macro Data: Any unexpected economic data (GDP, inflation, employment) could shift overall market sentiment.

Geopolitical Developments: US-China trade tensions, particularly around semiconductor exports and rare earth minerals.

Immediate Post-Period (Oct 29-30)

October 29: Microsoft and Alphabet earnings after market close. Results will set tone for November but occur after prediction period.

October 30: Apple earnings expected. Similarly occurs after our forecast window but anticipation may influence Oct 26 close.

Price/Indicator Conditions to Monitor

NVDA: Watch for break above $195 (recent high) for bull confirmation, or drop below $180 support for bear case.

MSFT: $520-525 range appears to be near-term resistance. Break above could signal run to $535+.

AAPL: Needs to reclaim $260 level to confirm bull case. Falling below $245 would be bearish signal.

GOOGL: Holding above $250 is crucial for bull narrative. Break below $245 could trigger technical selling.

Technical Indicators

NVDA: MACD showing sell signal, but RSI not oversold. Volume declining on recent upticks.

MSFT: Trading near middle of Bollinger bands, suggesting balanced short-term outlook.

AAPL: Flat year-to-date suggests lack of conviction. Needs catalyst to break out of range.

GOOGL: Recent volume surge on rally suggests institutional buying. Momentum indicators positive.

Investment Implications

For Conservative Investors

Recommendation: Hold existing positions, minimal new allocation

Conservative investors should prioritize capital preservation and steady income over aggressive growth during this period of elevated valuations and mixed signals.

Portfolio Approach:

Maintain current tech exposure: If you already own these stocks, hold positions through the volatility. These are high-quality businesses with strong fundamentals.

Microsoft most suitable: MSFT offers the best balance of growth (Azure) and income (recently increased dividend of $0.91/share, ~0.7% yield). Its diversified revenue streams provide stability.

Avoid chasing: Don’t initiate new positions at current levels. Wait for pullbacks of 5-10% to add exposure.

Risk management: If tech represents >30% of portfolio, consider trimming on strength to rebalance. The 3-month rallies (GOOGL +36%, NVDA +43%) create concentration risk.

Specific Actions:

Set stop-losses 8-10% below current levels for downside protection

Consider covered calls on AAPL and MSFT to generate income if holding 100+ shares

Allocate no more than 2-3% of portfolio to any single tech name

Diversify into defensive sectors (utilities, consumer staples) to balance risk

Rationale: While these companies have strong long-term prospects, near-term volatility is likely. Conservative investors should avoid trying to time the market and instead focus on portfolio balance and risk management.

For Moderate Investors

Recommendation: Selective accumulation with balanced approach

Moderate investors can take advantage of opportunities while managing risk through diversification and timing.

Portfolio Approach:

Allocate 15-20% to these four stocks collectively, with equal weight or slight overweight to NVDA and GOOGL

Dollar-cost average: Rather than buying all at once, spread purchases over the week or month to reduce timing risk

Pair trades: Consider relative value—GOOGL’s P/E of 26 vs. MSFT’s 38 suggests GOOGL may offer better risk/reward

Stock-Specific Strategy:

NVIDIA (25% of tech allocation):

Action: Accumulate on dips below $180. Bull case strongest but also highest volatility.

Reasoning: AI infrastructure spending cycle is real and multi-year. NVDA is the “picks and shovels” play. Price target of $216+ suggests good upside.

Risk: Most vulnerable to sharp corrections. Use tighter stops or smaller position size.

Alphabet (30% of tech allocation):

Action: Build position now, add more on any dip to $245-250 range.

Reasoning: Best value in mega-cap tech (P/E 26), strong momentum, diverse revenue, favorable antitrust outcome. Oct 29 earnings likely positive.

Risk: Recent 36% rally could pause. Be patient for entries.

Microsoft (25% of tech allocation):

Action: Initiate or add to positions around $510-515, avoiding purchases above $525.

Reasoning: Azure growth accelerating, Copilot monetization ramping, strong balance sheet. Dividend provides downside cushion.

Risk: Valuation premium limits upside. Better for stability than explosive growth.

Apple (20% of tech allocation):

Action: Small position or wait for clearer AI monetization. Consider adding if it drops to $245.

Reasoning: Underperformance suggests market skepticism. iPhone 17 and services growth are positives but less compelling than peers. Good value if it corrects.

Risk: Smallest conviction due to weakest AI narrative and China exposure.

Timing Strategy:

This week (Oct 20-26): Focus on GOOGL and NVDA if they show momentum. Accumulate MSFT on any weakness below $515.

After earnings (Oct 29-30): Reassess based on MSFT and GOOGL results. AAPL earnings could provide entry point if stock reacts negatively.

For Aggressive Investors

Recommendation: Active trading with concentrated positions

Aggressive investors can pursue higher returns by taking larger positions and using options strategies, accepting higher volatility.

High-Conviction Plays:

1. NVIDIA – Highest upside potential (+6.4% to $195)

Strategy: Largest position (35-40% of tech allocation). Consider call options for leveraged exposure.

Entry points: Buy now and add on any dip to $178-180. Scale in aggressively.

Price targets: $195 by Oct 26 (bull case), $210-220 by year-end

Options play: Buy Nov 1 $185 calls or Nov 15 $190 calls to capture upside with limited capital

Rationale: Every major indicator points to continued AI buildout. $300 price target, UAE deal, OpenAI partnership, and “insatiable” demand from CEO all suggest explosive near-term potential.

Risk management: Accept potential for 5-10% swings. Use stop-loss at $175 to limit downside.

2. Alphabet – Momentum trade with fundamental support (+5.8% to $268)

Strategy: Second-largest position (30% of tech allocation). Ride momentum into earnings.

Entry points: Current levels acceptable, add more on strength above $258 or dips to $248

Price targets: $268 by Oct 26 (bull case), $280+ after positive Oct 29 earnings

Options play: Buy weekly $255 calls or Nov 1 $260 calls for near-term speculation

Rationale: 36% rally over 3 months shows powerful momentum. P/E of 26 is cheap relative to growth. Gemini success, India investment, and antitrust relief create perfect setup.

Catalysts: Oct 29 earnings will likely beat. Position ahead of announcement.

3. Microsoft – Stable growth with options income (+4.2% to $535)

Strategy: 20-25% of tech allocation. Combine stock ownership with covered calls.

Entry points: Buy at current levels or on dips to $510

Price targets: $535 by Oct 26 (bull case), $550+ post-earnings

Options play: Buy stock and sell Nov 1 $525 covered calls to generate income. Or buy Jan 2026 $520 calls for longer-term exposure.

Rationale: Azure acceleration and Copilot traction are real. Earnings on Oct 29 should beat. Less volatile than NVDA but solid growth.

4. Apple – Contrarian opportunity (+3.9% to $262)

Strategy: Smallest allocation (10-15%) or skip entirely in favor of higher-conviction names.

Entry points: Only if it drops to $245 or below. Otherwise, underweight or avoid.

Price targets: $262 by Oct 26 (bull case) but $310 ultimate target per Wedbush

Options play: If playing, use long-dated calls (Jan 2026 $260 calls) rather than near-term, given weak momentum

Rationale: Risk/reward less attractive than peers. YTD underperformance suggests wait-and-see approach warranted. However, if iPhone 17 sales surprise positively, could see explosive move.

Portfolio Construction:

NVDA: 35-40%

GOOGL: 30%

MSFT: 20-25%

AAPL: 10-15% (or 0% and overweight NVDA/GOOGL)

Advanced Strategies:

Pairs trade: Long GOOGL / Short AAPL to capture relative value

Earnings play: Buy MSFT and GOOGL calls expiring Nov 1 ahead of Oct 29 earnings

Volatility play: Sell cash-secured puts on NVDA at $175 strike to generate income and acquire shares at discount if assigned

Sector rotation: If tech weakens, quickly rotate to other AI beneficiaries (AVGO, AMD, PLTR)

Risk Warnings for Aggressive Strategy:

This approach can result in significant losses (15-20%+) if market sentiment shifts

Options can expire worthless if stocks don’t move as expected

Concentrated positions amplify both gains and losses

Requires active monitoring and willingness to cut losses quickly

Not suitable for risk-averse investors or those nearing retirement

Methodology

Data Sources and Analysis Framework

This forecast combines quantitative analysis of historical price data with qualitative assessment of recent news, analyst sentiment, and macroeconomic factors.

1. Historical Price Analysis

Retrieved daily OHLCV (Open, High, Low, Close, Volume) data from Alpha Vantage for all four stocks

Analyzed 100 days of recent price action to identify trends, support/resistance levels, and volatility patterns

Current prices as of market close October 17, 2025:

NVDA: $183.22 (52-week range: $86.62-$195.62)

MSFT: $513.58 (52-week range: $344.79-$555.45)

AAPL: $252.29 (52-week range: $196.45-$260.00 est.)

GOOGL: $253.30 (52-week range: $140.00-$258.00)

2. News Sentiment Analysis

Comprehensive web search of major financial news sources dated October 2025

Categorized news items into bullish, bearish, and neutral sentiment

Weighted recent news (past week) more heavily than older news

Key sources: CNBC, Bloomberg, Yahoo Finance, Seeking Alpha, The Motley Fool, Wall Street analysts

3. Analyst Consensus

Compiled price targets and ratings from multiple Wall Street analysts

Calculated consensus estimates and identified outliers (both bullish and bearish)

Analyst sentiment breakdown:

NVDA: 58 of 64 “Buy” or “Strong Buy” | Consensus target $216.41 | Range $100-$300

MSFT: 33 of 34 “Buy” or “Strong Buy” | Consensus target $626.78 | Range $550-$680

AAPL: 21 of 41 “Buy” or “Strong Buy” | Consensus target $246-250 | Range $230-$310

GOOGL: 44 analysts “Strong Buy” avg | Consensus target $248.23

4. Technical Indicators

Simple moving averages (20-day, 50-day, 200-day)

MACD (Moving Average Convergence Divergence)

RSI (Relative Strength Index)

Volume analysis for confirmation of trends

Support and resistance level identification

5. Fundamental Factors

Recent earnings reports and guidance

Key metrics: Revenue growth, EPS growth, margin trends

Strategic initiatives (M&A, partnerships, product launches)

Competitive positioning in AI/cloud markets

6. Quantile Regression Approach

To express uncertainty, this analysis uses three quantiles representing different market scenarios:

10th Percentile (Bear Case): Represents pessimistic scenario where negative factors dominate. Approximately 10% of possible outcomes would be worse than this estimate. Based on: profit-taking, disappointing earnings, macro headwinds, technical breakdowns.

50th Percentile (Base/Median Case): Represents most likely scenario based on continuation of current trends with typical week-to-week volatility. This is not a simple average but the median expected outcome. Based on: maintaining recent momentum with normal consolidation, balanced news flow, stable macro environment.

90th Percentile (Bull Case): Represents optimistic scenario where positive factors align. Only 10% of possible outcomes would exceed this estimate. Based on: strong earnings beats, major partnership announcements, technical breakouts, momentum acceleration.

7. Monte Carlo Simulation Concepts

While not running formal Monte Carlo simulations, the quantile estimates incorporate probabilistic thinking by considering:

Historical volatility (standard deviation of daily returns over past 60 days)

Event-driven scenarios (earnings announcements, product launches)

Correlation with broader market indices

Industry-specific factors (AI investment cycle, semiconductor demand)

8. Time Horizon and Limitations

Forecast period: October 20-26, 2025 (one trading week)

End date: Friday, October 26, 2025 closing price

Confidence decreases with time: One-week forecasts are moderately reliable; multi-week or multi-month predictions would have much wider uncertainty bands

Limitations and Disclaimers:

Past performance does not guarantee future results

Unexpected events (geopolitical shocks, natural disasters, policy changes) could invalidate predictions

Earnings results on October 29-30 will significantly impact post-prediction period but occur after our forecast window

Market microstructure (algorithmic trading, options expiry, institutional rebalancing) can cause short-term deviations

This methodology cannot predict “black swan” events or overnight gaps

9. Probability Calibration

The quantile ranges were calibrated such that:

There’s roughly 80% probability the actual price falls between 10th and 90th percentile

There’s roughly 50% probability the actual price falls within ±3% of median estimate

The median represents the single “best guess” but with explicit acknowledgment of uncertainty

10. Validation Approach

Post-forecast, accuracy can be assessed by:

Did actual Oct 26 price fall within the 10th-90th percentile range?

How close was actual price to median estimate (percentage error)?

Were directional calls (up/down) correct?

How did predictions compare to analyst consensus targets?

Conclusion

The week ending October 26, 2025 presents a nuanced landscape for mega-cap technology stocks, with opportunities tempered by valuation considerations and near-term uncertainty.

Strongest Conviction: NVIDIA and Alphabet

NVIDIA emerges as the standout opportunity with a bull-case target of $195 (+6.4%), driven by an unprecedented confluence of positive catalysts. The company’s multi-trillion dollar AI infrastructure opportunity, evidenced by the $100 billion OpenAI partnership, $40 billion data center consortium, and UAE export approval, creates a powerful near-term setup. While recent profit-taking has created volatility, the fundamental demand picture remains extraordinarily strong. CEO Jensen Huang’s assertion that we’re at the “beginning of a new industrial revolution” appears increasingly validated by customer actions. Analysts’ Street-high price target of $300 and consensus target of $216 underscore substantial upside potential despite the stock’s already impressive 43% year-to-date gain.

Alphabet represents the best risk-adjusted opportunity among the four, combining strong momentum (up 36% in three months) with attractive valuation (P/E of 26 versus 34-38 for peers). The company’s 10% surge on news of its $15 billion India investment, favorable antitrust ruling, and Gemini’s App Store success suggests a narrative shift from “search-dependent legacy player” to “AI innovation leader.” With Google Cloud demonstrating sustained growth ($13.6 billion in quarterly sales), YouTube maintaining dominance ($9.8 billion in ad revenue, +13% YoY), and the company’s vast data assets providing an AI training advantage, Alphabet appears positioned for multiple expansion. The October 29 earnings catalyst occurring just after our forecast window adds to the appeal, as positive positioning ahead of results could drive the stock toward $268.

Solid but Less Compelling: Microsoft

Microsoft offers stability and quality but faces near-term headwinds from elevated valuation (P/E of 38.3, above its five-year average). The Azure growth acceleration to 39% in Q4 FY2025 is impressive and the Copilot ecosystem is gaining real traction, as evidenced by Barclays’ expansion from 15,000 to 100,000 licenses. However, at $514 per share, much of this good news appears priced in. The October 29 earnings represent both opportunity and risk—a beat could push the stock toward $535, but any disappointment could trigger a sharp correction given the premium valuation. For long-term investors, MSFT remains an excellent core holding combining growth (Azure, AI) with income (recently increased dividend). For traders seeking near-term alpha, the risk/reward is less attractive than NVDA or GOOGL.

Wait-and-See: Apple

Apple presents the most challenging case of the four. The company’s year-to-date performance of just 1-3% (versus 20-40%+ for peers) signals persistent market skepticism despite strong iPhone 17 demand and record services revenue. While Wedbush’s $310 price target and JPMorgan’s $280 target suggest significant upside potential, the lack of a clear AI monetization story continues to weigh on sentiment. The $500 billion commitment to US AI investments is promising but vague. The October 30 earnings (just after our forecast period) represent a binary event that could either validate the bull thesis or confirm fears. For now, Apple appears to be in “prove it” mode, making it the lowest-conviction name among the four. Investors seeking exposure should consider waiting for either a pullback to $245 or a post-earnings dip.

Balancing Act Required

The overarching theme is that while AI fundamentals remain extraordinarily bullish, near-term positioning is critical. All four stocks have enjoyed strong runs, creating vulnerability to profit-taking. The 80% probability bands (10th to 90th percentile) range from -1.7% to +6.4%, reflecting genuine uncertainty about whether momentum continues or consolidation dominates. For most investors, a diversified approach—owning 2-3 of these names rather than concentrating in one—provides the best balance of opportunity and risk management.

Final Assessment

Based on the comprehensive analysis of fundamentals, technicals, sentiment, and catalysts:

Most Bullish: NVIDIA (bull target $195, +6.4%) followed closely by Alphabet (bull target $268, +5.8%)

Moderate Outlook: Microsoft (bull target $535, +4.2%)

Cautious: Apple (bull target $262, +3.9%)

The median case suggests modest gains across the board (0.7% to 2.1%), while downside risks are contained (worst case -1.7% to -2.9%). This risk/reward profile favors constructive positioning while maintaining discipline on valuation and risk management. Investors should approach the week with optimism tempered by awareness that the October 29-30 earnings will be the true test of whether these valuations are justified.

The AI revolution is real, multi-year, and just beginning. These four companies are at the epicenter. The question for the week ahead isn’t whether they’re good long-term investments—they almost certainly are. It’s whether current prices offer attractive entry points or whether patience will be rewarded with better opportunities. Our analysis suggests the answer varies by stock: Act now on NVDA and GOOGL, be selective on MSFT, and wait for AAPL.

As always, individual circumstances, risk tolerance, and investment timeframe should guide final decisions. The predictions provided represent probabilistic outcomes, not certainties, and the wide uncertainty bands remind us that markets can surprise in both directions.

Join the Conversation!

Do you agree with our predictions for NVDA, MSFT, AAPL, and GOOGL? Which stock do you think offers the best opportunity for the week ahead? Are we too bullish on AI infrastructure spending, or is this just the beginning of a multi-year boom?

Share Your Predictions:

Drop your own price targets in the comments below

Tell us which of these four stocks you’re most confident in—and why

If you had to pick just one for the week, which would it be?

Request Other Assets: We can analyze any publicly traded stock, crypto, commodity, or ETF. Want to see predictions for:

Semiconductor plays like AMD, AVGO, or TSM?

AI software stocks like PLTR, SNOW, or CRM?

Crypto giants like BTC, ETH, or SOL?

Other mega-caps like AMZN, META, or TSLA?

Let us know in the comments and we’ll analyze your requests!

Subscribe for Weekly Predictions: Don’t miss our next analysis. Subscribe to receive:

Weekly price predictions with uncertainty quantiles

In-depth fundamental and technical analysis

Actionable investment recommendations for all risk levels

Early alerts on major market catalysts and earnings

Hit that subscribe button to stay ahead of market moves. See you next week! 📈

Disclaimer

This Report is NOT Financial Advice

The information provided in this report is for educational and informational purposes only. It should not be construed as financial, investment, legal, or tax advice. The predictions, analysis, and recommendations presented represent the author’s opinions based on publicly available information and are subject to change without notice.

Key Points:

Past performance does not guarantee future results

All investments carry risk, including potential loss of principal

Individual circumstances vary; what’s suitable for one investor may not be appropriate for another

Always conduct your own due diligence before making investment decisions

Consult with a qualified financial advisor before taking any action based on this information

No Warranty: While efforts were made to ensure accuracy, no warranty is made regarding the completeness, accuracy, or timeliness of the information presented. Market conditions can change rapidly and unpredictably.

Forward-Looking Statements: This report contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those predicted.

By reading this report, you acknowledge that you understand and accept these limitations and that you alone are responsible for your investment decisions.